You might also like

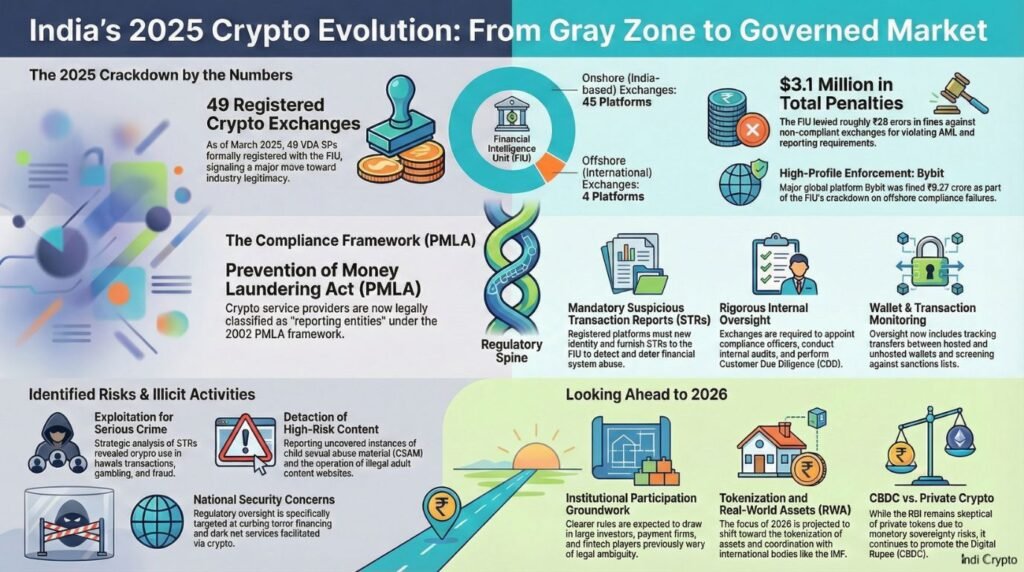

For years, India’s cryptocurrency industry operated in a grey zone—neither formally recognised nor outright banned. This uncertainty left investors and entrepreneurs in a state of constant suspense. But 2025 marked a pivotal shift. Contrary to the widespread fear of an outright ban, 2025 was the year India finally gave its crypto industry a regulatory spine, reshaping how exchanges operate, how users trade, and how authorities enforce the rules. This overhaul pulled crypto out of the shadows and into a defined compliance framework.

Here are five of the most surprising and impactful truths about this regulatory transformation.

The Goal Wasn’t a Ban—It Was Legitimacy

The primary purpose of the 2025 policy shift was not to eliminate crypto but to pull the industry out of regulatory limbo. This was achieved by bringing all virtual digital asset service providers under the purview of India’s Prevention of Money Laundering Act (PMLA). The regulator’s objective was clear: reduce the risks associated with money laundering and terror financing without shutting the door on legitimate crypto activity. For exchanges, this meant higher operational costs but also newfound regulatory legitimacy.

The message is clear: crypto can operate in India—but only within the rules.

One Financial Watchdog Is Now in Charge

Unlike many countries where multiple agencies supervise crypto, India designated a single-point authority to oversee the entire ecosystem: the Financial Intelligence Unit (FIU), which operates under the Union Finance Ministry. This centralised approach contrasts sharply with the fragmented regulatory landscapes in countries like the U.S., positioning the FIU as an undisputed authority and eliminating jurisdictional ambiguity. The FIU imposed a new registration mandate and a strict set of rules for all registered exchanges.

New compliance requirements include:

- Submitting Suspicious Transaction Reports (STRs) to flag potential illicit activity.

- Appointing designated directors and principal officers to ensure accountability.

- Implementing internal audits and periodic risk assessments.

- Conducting rigorous Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD).

- Screening all transactions against global sanctions lists.

- Monitoring wallets and tracking transfers between hosted (exchange) and un-hosted (private) wallets.

These measures weren’t theoretical; the FIU’s analysis of STRs from these exchanges quickly uncovered the exploitation of crypto for serious crimes, from hawala transactions to darknet services, validating the regulator’s aggressive stance.

The Numbers Are Staggering: 49 Registrations and $3.1 Million in Fines

The FIU’s regulatory push delivered swift and measurable outcomes by March 2025. A total of 49 cryptocurrency exchanges successfully registered with the regulator, including 45 based in India (“onshore”) and four operating from abroad (“offshore”).

Alongside registration came decisive enforcement. The FIU levied penalties totalling approximately ₹28 crore (about $3.1 million) against exchanges found to be in violation of anti-money laundering and reporting requirements. In one of the most prominent cases, the global platform Bybit was fined ₹9.27 crore, sending a clear signal that non-compliance would not be tolerated. This was not an isolated case, as the FIU has launched probes into other global platforms over tax compliance and reporting failures.

Tension Remains Between Regulators and the Central Bank

Despite the FIU’s new framework, a core challenge remains: the Reserve Bank of India’s (RBI) long-standing institutional scepticism toward private cryptocurrencies. The RBI has repeatedly warned that private crypto assets pose significant risks to financial stability and monetary sovereignty. While its previous banking restrictions no longer stand, the central bank continues to favor its own central bank digital currency (CBDC) over privately issued tokens.

This underlying tension means India’s regulatory story is far from finished. With dozens of exchanges now operating under FIU oversight, pressure is building for a more comprehensive framework that goes beyond anti-money laundering enforcement.

India’s actions in 2025 were a turning point, not a final destination. The overhaul established clear rules for crypto’s existence rather than moving to destroy it. The country has drawn a firm line between compliant innovation and unchecked activity.

The industry now looks ahead to the next phase of regulation, which will likely address complex topics like the tokenization of real-world assets (RWA) and the legal framework for stablecoins. This sets the stage for a fundamental question about the nation’s role in the new digital economy.

What comes next will determine whether India becomes a tightly regulated participant in the global digital asset economy, or simply a cautious gatekeeper watching from the sidelines.